Our Solution

Risk Solutions Captive has developed a health insurance captive that provides innovative products, including self-funding, for companies with 50 or more enrolled employees. As the TPA, Health Cost Solutions (HCS) provides the foundation for Risk Solutions Captive offering a variety of services including claims payment, cost containment, billing, reporting and COBRA services. By partnering with a highly-rated reinsurance carrier and Health Cost Solutions, Risk Solutions Captive offers risk protection from high-dollar claims exposure and top-notch service.

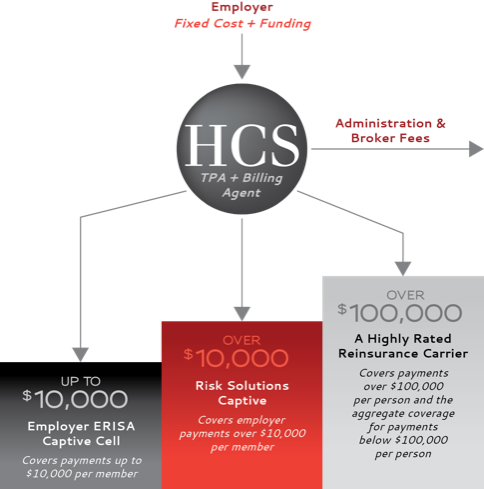

The Process

$0 - $10,000/member: As a Risk Solutions Captive customer, employers are responsible for up to $10,000/member.

Over $10,000: In the event payments exceed $10,000/member, Risk Solutions Captive will provide financial coverage up to $100,000/member.

Over $100,000: a highly-rated reinsurance carrier will reimburse when payments exceed $100,000/member. This soothes the financial burden of large healthcare expenditures, while offering protection from unforeseen healthcare costs.

In addition to our captive solution, clients are able to select Value Based Payments through HCS as an added cost-saving opportunity.

What is Value Based Payments (VBP)?

Our VBP product benchmarks clients’ institutional claims costs against a Medicare-based pricing system. The calculated result is a fair and reasonable price for each procedure, plus clients still receive their network discounts for all other services.

In addition to the innovative pricing technology, clients have a team of seasoned negotiators who work with hospitals and facilities to determine pricing agreements pre-procedure, ensuring that the facility is fairly reimbursed and mitigating the possibility that the member will be balance-billed.